The relentless churn of the cryptocurrency world demands constant innovation, a perpetual race for efficiency and profitability. Nowhere is this truer than in the realm of mining, where the quest for lower energy consumption has become a paramount concern, driving the Green Mining Revolution. This isn’t just about altruism; it’s about survival. As Bitcoin’s hashrate surges and Ethereum transitions to Proof-of-Stake, the economics of mining hinge increasingly on squeezing every last bit of performance out of each watt consumed.

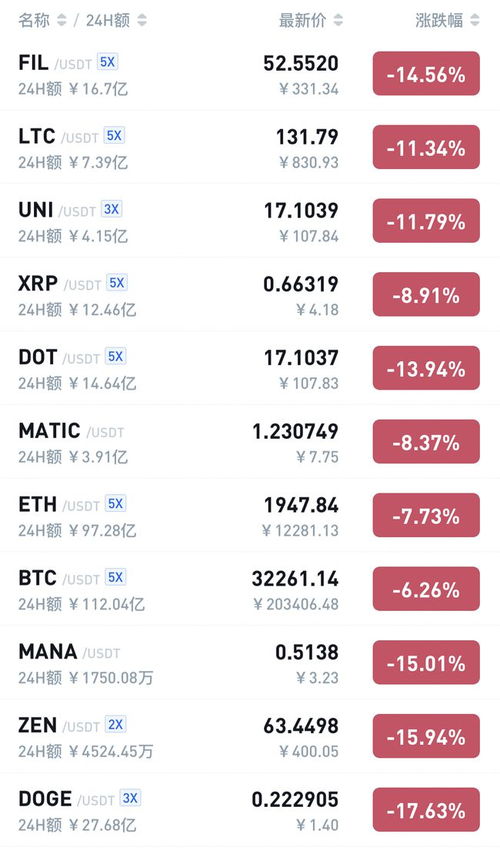

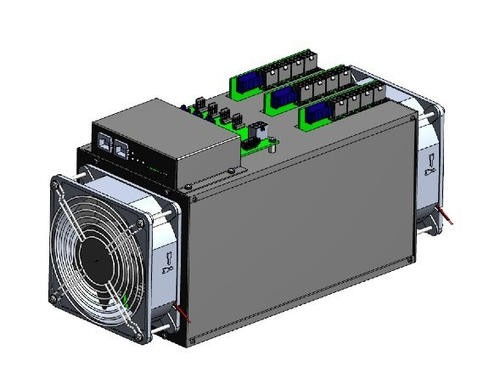

The price of low-consumption hardware is a moving target, dictated by a complex interplay of factors: chip availability, manufacturing costs, market demand, and the ever-fluctuating values of cryptocurrencies like Bitcoin (BTC), Dogecoin (DOGE), and Ethereum (ETH). An ASIC miner optimized for SHA-256, the algorithm underlying Bitcoin, will command a different price than a GPU rig configured for Ethereum mining, even if their power consumption is similar.

The allure of passive income through mining is powerful, but the reality is often a stark lesson in technological obsolescence. A mining rig purchased today could be rendered unprofitable in a matter of months due to rising difficulty, more efficient hardware entering the market, or a drop in cryptocurrency prices. Evaluating the total cost of ownership, including electricity, cooling, and potential repairs, is crucial.

The energy consumption of a mining operation is not only a financial burden but also an environmental one. Regions with cheap and abundant renewable energy sources are becoming increasingly attractive for miners, leading to the rise of “green” mining farms powered by solar, wind, or hydro power. This shift towards sustainability is driven by both ethical considerations and the economic imperative to minimize electricity costs.

Mining machine hosting services offer a compelling alternative for those lacking the space, technical expertise, or access to cheap electricity required to run their own mining rigs. These services typically provide secure facilities, reliable internet connectivity, and expert maintenance, allowing miners to focus on optimizing their configurations and maximizing their returns.

The transition of Ethereum to Proof-of-Stake (PoS) marked a significant shift in the landscape of cryptocurrency mining. PoS eliminates the need for energy-intensive mining, replacing it with a system where validators stake their ETH to secure the network. This has led to a decline in demand for GPU mining rigs previously used for Ethereum, but also opened up new opportunities for mining other cryptocurrencies that still rely on Proof-of-Work (PoW).

Dogecoin, initially created as a lighthearted meme coin, has unexpectedly found a solid footing in the crypto world. While not typically mined with ASICs as Bitcoin is, it can be mined using the same Scrypt algorithm as Litecoin, providing a potential avenue for diversification for miners.

The secondary market for used mining hardware is a dynamic and often unpredictable space. The value of a used ASIC miner or GPU rig depends heavily on its age, efficiency, and the current profitability of mining the relevant cryptocurrency. Savvy buyers can often find good deals on older hardware, but it’s essential to carefully research the market and understand the risks involved.

Ultimately, the Green Mining Revolution is about finding innovative ways to reduce the environmental impact of cryptocurrency mining while maintaining its economic viability. This requires a combination of technological advancements, responsible energy sourcing, and a commitment to sustainability from all stakeholders in the industry.

The future of mining may lie in niche cryptocurrencies and specialized algorithms that are resistant to ASIC mining, favoring GPU-based systems. This could lead to a more decentralized and accessible mining ecosystem, empowering individual miners and fostering innovation in hardware and software.

Leave a Reply