The world of cryptocurrency mining is a thrilling blend of technology, strategy, and sheer ambition, where digital coins like Litecoin emerge as hidden gems in a market dominated by giants such as Bitcoin. Litecoin, often dubbed the “silver to Bitcoin’s gold,” was created in 2011 by Charlie Lee as a faster and more efficient alternative to BTC. It utilizes the Scrypt algorithm, which demands specialized hardware like ASIC miners to unearth these virtual treasures. In this article, we’ll dive into the top-rated Litecoin ASIC miners, exploring their reviews, prices, and the tantalizing profit potential they offer. But remember, mining isn’t just about hardware; it’s about smart hosting choices, market fluctuations, and even the quirky rise of coins like Dogecoin, which started as a meme but now boasts a fervent community.

Let’s kick off with the heavy hitters: the Antminer L7 and the Innosilicon A6. The Antminer L7, manufactured by Bitmain, stands out as a powerhouse in the Litecoin mining scene. With a hash rate of up to 9.5 GH/s, this beast can churn out Litecoin blocks at lightning speed, though it guzzles around 3425 watts of power—making energy costs a critical factor for profitability. User reviews on platforms like Amazon and Reddit rave about its reliability, with one miner exclaiming, “This thing runs like a dream, pulling in steady profits even during network congestion.” However, at a price tag hovering around $2,500, it’s not for the faint-hearted. Compare that to the Innosilicon A6, which offers a more modest 2.2 GH/s but at a lower price point of about $1,200, appealing to newcomers. Its efficiency is praised for quieter operation and better heat management, ideal for home setups or professional mining farms where space and noise are concerns. Yet, as Ethereum transitions to proof-of-stake, miners are pivoting to Scrypt-based coins like Litecoin, adding an unpredictable twist to the market.

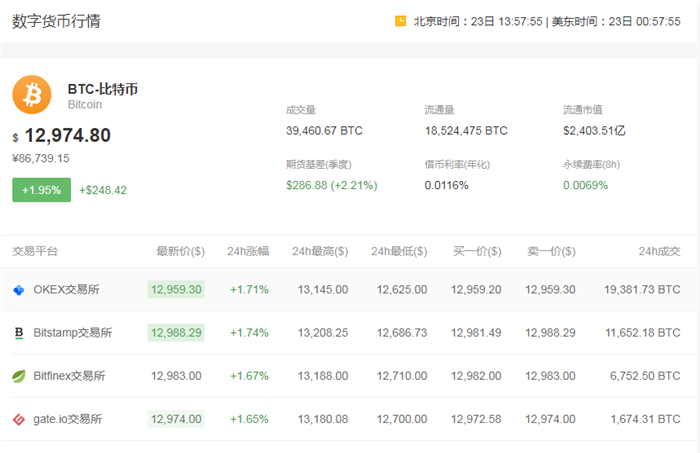

Profit potential in Litecoin mining hinges on a volatile cocktail of factors: current coin prices, electricity rates, and the all-important hosting services. Right now, with Litecoin trading around $150, a top-tier miner like the Antminer L7 could net you approximately $10 to $20 daily, depending on your location’s power costs. But don’t forget the bigger picture—Bitcoin’s dominance means that fluctuations in BTC often ripple through to altcoins like LTC, creating bursts of opportunity or sudden dips. For instance, if Dogecoin surges due to social media hype, it might indirectly boost interest in other proofs-of-work currencies. To maximize returns, consider hosting your mining rig at a dedicated facility. Companies specializing in mining machine hosting provide secure, climate-controlled environments that handle everything from maintenance to connectivity, potentially slashing your operational costs by up to 30%. This setup not only safeguards your investment but also allows you to tap into pooled resources, much like Ethereum’s old mining pools that fostered community-driven efforts before the Merge.

Delving deeper, the evolution of mining technology reveals a fascinating interplay between hardware and cryptocurrency ecosystems. Take the concept of a mining rig, which is essentially a customized setup of multiple miners working in harmony. For Litecoin, a well-optimized rig could include several ASIC units linked to advanced cooling systems, turning a simple Miner into a profit-generating machine. Meanwhile, Bitcoin’s ASIC miners, like the Whatsminer M30S, demand even more robust infrastructure, often found in vast mining farms sprawling across regions with cheap electricity, such as Iceland or Texas. These farms, humming with thousands of machines, represent the industrial scale of crypto mining, where efficiency isn’t just key—it’s survival. In contrast, Dogecoin mining, which also uses Scrypt, can be more accessible, drawing in hobbyists with lower barriers to entry, though profits remain erratic due to its inflationary model.

As we wrap up, it’s clear that investing in top-rated Litecoin ASIC miners isn’t merely a technical decision; it’s a strategic one that weaves together the threads of Bitcoin’s stability, Ethereum’s innovation, and even Dogecoin’s unpredictability. Prices for these miners fluctuate with market demand, but the real allure lies in their profit potential—especially when paired with reliable hosting services that mitigate risks like hardware failures or network outages. Whether you’re a seasoned miner eyeing expansion or a curious newcomer, remember that the crypto landscape is as dynamic as it is rewarding. By choosing the right tools and partners, you could unlock not just Litecoin rewards, but a gateway to broader financial independence in this ever-evolving digital frontier.

Leave a Reply