Norway has rapidly emerged as an attractive destination for hosting ASIC mining machines, drawing attention from crypto enthusiasts and large-scale miners alike. The country’s frigid climate naturally assists in cooling these power-hungry devices, significantly curtailing the energy cost typically associated with cryptocurrency mining. Yet, despite these environmental advantages, hosting mining rigs in Norway involves a complex web of financial considerations. From electricity prices fluctuating due to the Nordic energy market to infrastructure costs, miners must scrutinize numerous factors to maximize profitability in this unique locale.

Electricity is the lifeblood of any mining operation, and the Nordic region’s electricity market is particularly dynamic. Norway, relying heavily on hydroelectric power, offers renewable and relatively stable energy sources, but the prices can swing with demand and supply conditions across Scandinavia. This volatility means hosting ASIC miners here isn’t solely about low baseload costs but also about timing and contractual strategies. Many hosting providers offer flexible pricing models, including spot pricing and fixed rates, which can significantly impact operational margins for miners deploying rigs targeting Bitcoin (BTC) or Ethereum (ETH).

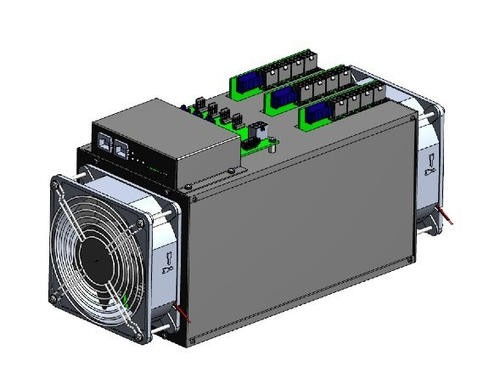

Another critical dimension is the choice of mining hardware. State-of-the-art ASIC miners designed specifically for Bitcoin yield higher hash rates and efficiency, enabling miners to capitalize on BTC’s market highs. However, these machines can also be deployed to mine alternative proof-of-work coins or support mining pools that tackle diverse cryptocurrencies. For Ethereum miners, although ETH has transitioned to proof-of-stake, many ASIC rigs still find utility in mining other SHA-256 or Ethash-based coins. The compatibility and lifespan of mining rigs thus play into overall cost calculations when hosting machines abroad.

Hosting companies in Norway typically provide comprehensive services—from secure rack space and power provisioning to 24/7 monitoring and maintenance—essential for sustaining mining farms amid long-term network profitability fluctuations. The cost of hosting services encompasses not only electricity but also cooling infrastructure, physical security, and network connectivity. As a result, miners often face a balancing act: investing in superior hosting conditions to ensure maximum uptime and efficiency versus minimizing upfront and recurring expenses.

The strategic significance of hosting extends beyond operational costs. For miners focusing on cryptocurrencies like Dogecoin (DOG), whose algorithm can be merged mined alongside Litecoin, the ability to swiftly adapt mining configurations in response to price trends is vital. Hosting providers that deliver scalable solutions empower miners to expand or reduce capacity with minimal delay, a feature pivotal during volatile market conditions. Moreover, the trend toward cloud mining and hosting reflects a broader industry shift, where decentralization of mining farms helps mitigate risks associated with hardware failure and regulatory pressures in certain jurisdictions.

Moreover, integration with cryptocurrency exchanges is an often-overlooked aspect but a noteworthy consideration when evaluating hosting costs. Efficient miners benefit from reduced latency and faster transaction processing when their hosting services include optimized connectivity to major crypto exchanges. This advantage can enhance trading strategies, such as rapid asset liquidation or switching between mining rewards settlements. As miners juggle outputs from Bitcoin, Dogecoin, Ethereum forks, and other altcoins, seamless exchange integration becomes a subtle but decisive factor in operational efficiency and profitability.

Regulatory landscapes also subtly influence cost structures for hosted mining operations in Norway. Although relatively crypto-friendly, shifting governmental policies around renewable energy usage, taxation, and cryptocurrency transactions can introduce unforeseen expenses or constraints. Hence, miners often collaborate closely with hosting providers who maintain up-to-date compliance frameworks, ensuring sustainable operations over extended periods. This attention to governance can differentiate successful mining enterprises from transient ones, particularly in a competitive BTC mining environment.

Ultimately, the decision to host ASIC mining machines in Norway hinges on a multifaceted analysis of energy economics, hardware capabilities, service quality, market volatility, and logistical efficiency. BTC miners can exploit Norway’s cold climate and renewable power, but must navigate electricity market volatility and hosting fees. Ethereum-focused operations, while pivoting due to ETH’s consensus changes, can adapt with alternative coins or dual mining strategies enabled by flexible rigs. Dogecoin enthusiasts benefit from merged mining optimizations and responsive hosting services. Across all scenarios, the evolution of mining farms towards modular, remotely managed facilities marks a transformative trend in how miners engage with the global crypto economy.

Leave a Reply